Florida - Florida real estate for sale - Cape Coral real estate purchase - market trends

After a tremendous boom in the US real estate market, real estate prices collapsed dramatically in 2007/2008, particularly in the California and Florida regions. The following chart shows the development of real estate prices in the 20 metro areas of the USA - an incredible boom followed by a crash in real estate prices in 2007-2009:

A look at the Case-Shiller House Price Index since 2000 clearly shows the development of the devastating real estate bubble in the USA, which peaked in July 2006 at 206.52 index points. House prices doubled between 2000 - 2006, after which the bubble burst caused by massively increasing interest rates. After the expiration of government aid to stabilize the real estate market in April 2010, the negative reaction came promptly: in March 2011, after a significant interim recovery, a new low was reached after the outbreak of the crisis (double dip). In December 2011, a new low in average US real estate prices was noted and a third low of 136.64 points was reached in March 2012 (triple dip).

Since the beginning of 2013, there have been clear upward outbreaks in real estate prices on a broad front. Since its low after the real estate crisis in March 2012 (136.64 index points), real estate prices have recovered very significantly. The current S&P Case-Shiller House Price Index of the 20 metro areas shows that in January 2018 the price level almost reached the peak of the real estate boom in 2006. The statistical data usually comes two months late and refer accordingly to the situation two months ago.

Even the Corona pandemic had no negative impact on the price trend of real estate in Florida. On the contrary, real estate prices in Florida continue to rise steadily and are in an intact upward trend. In July 2021, home prices increased 19.2 percent from the same month last year, according to the Federal Housing Finance Agency (FHFA). A declining inventory of homes, a running out of land and historically low mortgage rates drove prices higher. More and more people are leaving the metropolitan areas of the U.S., companies are settling and are boosting real estate prices significantly.

Again the advice from T. Harv Eker: “Don’t wait to buy real estate, buy real estate and wait.”

If you want to invest in U.S. real estate, the search for a suitable property is very simple: Almost all properties for sale are listed in a central database (MLS). Therefore, ask an experienced broker you trust to look for a suitable house, apartment, or vacant land.

Search for your Florida Property now!

Real estate prices in Cape Coral

In Southwest Florida, real estate in Cape Coral was hit especially hard after prices had literally exploded during the previous boom years. As most buyers had financed Cape Coral properties on a short-term loan basis, many homeowners experienced increasing financial difficulties as interest rates subsequently rose. While real estate prices in the U.S. have only been recovering since 2013, the turnaround in Cape Coral, Lee County, was already initiated at the beginning of 2011.

A comparison of property prices in Cape Coral using the chart below shows that the percentage increase in property prices in Cape Coral since the beginning of 2012 has developed almost in parallel with price developments in Miami or Naples, but at a significantly more favorable price level. The chart also shows that prices have now exceeded significantly the highs of 2006.

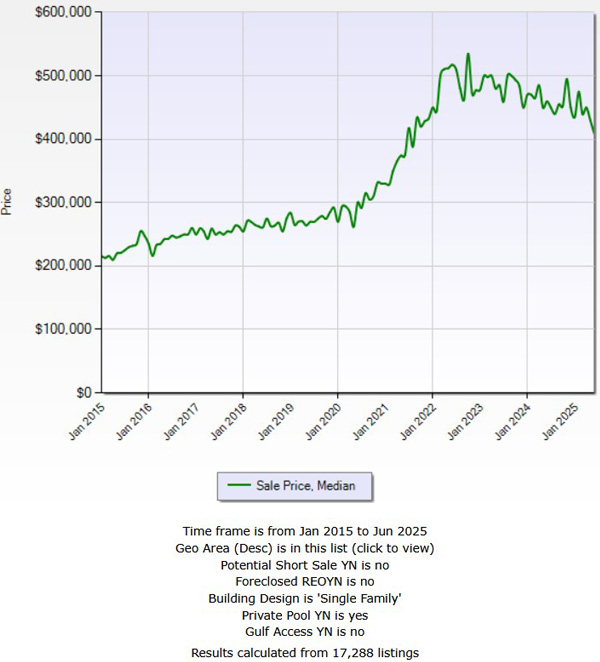

Real estate prices for off-water homes with Pool in Cape Coral - all years of construction

In October 2010, the house price for a single-family home with pool (non-waterfront) in Cape Coral was $136,000. In January 2020, prices for a home with pool (non-waterfront) were $270,000 and in October 2022 the price peak was reached at $535,000 - a price increase of 98% in just under 3 years. In the course of 2023, there was a sustained and overdue correction of this exorbitant price increase and prices fell by around 24% from the peak in October 2022 to an average of $409,000 (as at June 2025)

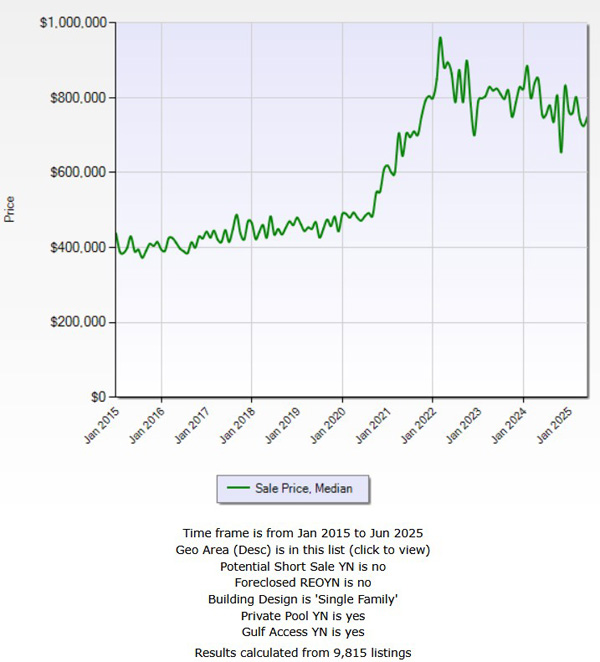

Real estate prices for Gulf access homes in Cape Coral - all years of construction

After crashing from over $700,000 in February 2006 (real estate hype), prices for homes with boat access to the Gulf of Mexico bottomed out at $295,750 in August 2011. Prices reached $489,000 in January 2020 and peaked at $961,000 in March 2022 - a price increase of almost 97% in just over two years. From the end of 2022, there was a sustained and overdue correction of this exorbitant price increase and prices fell by around 22% from the peak in March 2022 to an average of $750,000 (as at June 2025)

Off-water Homes in Cape Coral - starting at $450,000 (average Location)

Existing properties without access to the Gulf of Mexico can be purchased for $450,000 (average location).

Gulf Access Homes in Cape Coral - $620,000 (average location)

Existing properties with access to the Gulf of Mexico can be purchased for $620,000 (average location) or $700,000 upwards (good locations).

New Construction, Gulf Access Home, average location - starting at $620,000 (lot included)

New construction with Gulf access can be purchased for $620,000 (lot, 3 bedrooms, 2 bathrooms, Pool, 3-car garage, boat dock, boat lift). In good locations $700,000 upwards.

When is the right time to buy a property in Florida?

This is the million dollar question. Many prospective buyers with a budget of $600,000 and up often opt for new construction in Cape Coral, as evidenced by our current sales in 2020, 2021, 2022, 2023 and 2024. Many investors are securing waterfront lots in Cape Coral with boat access to the Gulf of Mexico in good to very good locations (lot prices from $350,000). If you decide to buy a non-waterfront property in a good location, you will have to calculate from $120,000. A high-quality new build (solid construction) in a non-waterfront location in a good location is available from $600,000 (including lot, house and pool with spa), e.g. the Coral Cay vacation home. In 2009, the following sentence appeared here on our website:

In 5 years, you will look at the price index with the usual remarks: 'If only we'd bought', but with "if" or "should have" nobody has become rich - ever.

In March 2010, we strongly emphasized the expected price increases and exchange rate developments in our BLOG at the time. In March 2012, we again emphasized the risk of rising prices and the appreciation risk of the dollar. Both forecasts have come true to the detriment of European buyers, real estate prices have risen massively and the dollar has appreciated much more than expected until 2022. Today, one can only say ... if only we had.While in 2008 - 2011 the exchange rate was still super favorable for Europeans ($1.40 - $1.55 for one euro) and the supply of real estate was huge due to the US real estate crisis, the additional icing on the cake of the exchange rate advantage melted away from $1.22 (May 2021) to $0.98 (September 2022). At the same time, real estate prices skyrocketed after the coronavirus pandemic until the end of 2022/beginning of 2023. In May 2020, the average sales price of a home in Cape Coral was $239,020 and rose over 80% to $436,475 by May 2022. The rapid surge in real estate prices made the Cape Coral/Fort Myers metro region one of the fastest appreciating housing markets in the USA.

Tip:

If you want to fulfill your dream of a Florida property today, make sure you secure your financing and choose an experienced real estate agent with excellent references who will keep you informed on a daily basis. If the property of your desire appears on the screen, you must be able to act quickly - talk to us.

USA:

USA:  E-Mail:

E-Mail: